- Home

- |

- About Us

- |

- Working Groups

- |

- News

- |

- Rankings

- WEF-Global Competitiveness Report

- Ease of Doing Business Report

- IMD-World Competitiveness Yearbook

- TI-Corruption Perceptions Index

- HF-Economic Freedom Index

- WEF-Global Information Technology Report

- WEF-Travel and Tourism Report

- WIPO-Global Innovation Index

- WB-Logistics Performance Index

- FFP-Fragile States Index

- WEF-Global Enabling Trade Report

- WEF-Global Gender Gap Report

- Gallery

- |

- Downloads

- |

- Contact Us

Statement from the NCC on the WEF Global Competitiveness Report 2014-2015

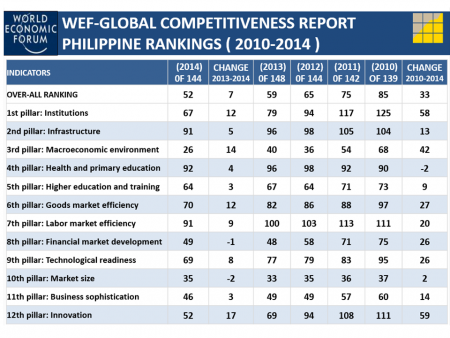

Philippines is Most Improved Country in WEF Global Competitiveness Report since 2010; Up 7 this year to No. 52

We are pleased to inform you that the Philippines has advanced 7 more notches to No. 52 in the World Economic Forum’s Global Competitiveness Report 2014-2015, from No. 59 last year. The country has now gained a total of 33 places from 85th in 2010, making it the most improved country overall since 2010. This latest report brings us closer to our goal of moving from the bottom-third of world rankings in 2010 to the top-third by 2016.

The Global Competitiveness Report is an annual publication that provides a comprehensive picture of the productivity and competitiveness of a country by gathering statistical and survey data on over 100 factors grouped into 12 pillars or categories. It is one of the most widely-read competitiveness reports and is highly correlated to investment attractiveness. This year, we moved up in 10 of the 12 categories of the index. Our strongest performing areas were Macroeconomic Environment (up 14 from 40th to 26th); Business Sophistication (up 3 from 49th to 46th); Innovation (up 17, from 69th to 52nd); Higher Education and Training (up 3 from 67th to 64th); Institutions (up 12, from 79th to 67th); and Technological Readiness (up 8, from 77th to 69th).

Out of 114 indicators measured, the Philippines now has 67 indicators ranked at the upper half of world rankings. Only 5 are ranked in the bottom 20%.

Over the last four years, our greatest gains have been in the areas of innovation (up 59 from 111th to 52nd), institutions (up 58 from 125th to 67th), and macroeconomic environment (up 42 from 68th to 26th). We have improved perceptions not only on the capacity of local companies to innovate (up 50 from 80th to 30th) but also on the extent that government procurement of advanced technology products can foster innovation (up 76 from 129th to 53rd). Higher rankings on government budget balance (up 38 from 63rd to 25th) and government debt (up 44 from 102nd to 58th) relative to GDP have also contributed to a more stable macroeconomic environment.

While we recorded improvements in most categories, our global rankings remained low and indicated large room for improvements in Labor Market Efficiency (up 9, from 100th to 91st); Infrastructure (up 5, from 96th to 91st); and Health and Primary Education (up 4, from 96th to 92nd).

The report once again highlighted the significant strides in the Institutions pillar, which essentially focuses on Governance and Anti-Corruption. The pillar looks at the legal and administrative environment, as well as government attitudes and efficiency. Since 2010, five of the top ten indicators in which the Philippines recorded the biggest gains were under Institutions. Moves against “diversion of public funds due to corruption” improved from 135th to 78th. The battle against “favoritism in decisions of government officials” also gained ground from 131st to 66th. Government is also perceived to be more efficient in public spending (118th to 60th). On the private sector side, businesses consider it easier to challenge government actions and/or regulations through the legal system (116th to 56th). Moreover, the ethical behavior of firms has been rated higher (129th to 49th).

We view the rise in our Institutional and Macroeconomic Environment rankings as a significant sign that good governance and economic development are closely linked. As trust in government rises, investor confidence and economic growth follow.

While the report acknowledged that bold reforms initiated by government have yielded positive results, it also identified pressing structural issues that need to be addressed to ensure sustainable and inclusive growth. The five most problematic factors for doing business in the Philippines were corruption, inadequate supply of infrastructure, tax regulations, inefficient government bureaucracy, and tax rates. Our lowest-ranked indicators include the number of procedures to start a business (141st), redundancy costs (124th), number of days to start a business (119th), and imports as a percentage of GDP (119th).

At the World Economic Forum on East Asia held in Manila last May, WEF Founder and Executive Chairman Klaus Schwab cited “the progress the country has made on so many parameters of competitiveness” and was impressed by reforms that have been achieved and will be achieved. John Pang, chairman of the WEF Global Advisory Council on Southeast Asia, added, “There’s a very strong sense that the Philippines is on track. It’s back and there’s a lot to look forward to.”

The Philippines is now ranked 5th of nine in the ASEAN and is at the cusp of breaking into the top third of global rankings. We still follow Singapore, Malaysia, Thailand, and Indonesia but recorded the largest gain in ASEAN this year. We are presently ahead of Vietnam, Lao, Cambodia, and Myanmar. Brunei was not covered in this year’s edition of the report.

The report gives us a good diagnostic tool for identifying our strengths and weaknesses. Over the next two years, we will be focusing on the areas which require urgent attention such as Infrastructure and Primary Health and Education, and others. With the continued support and cooperation of the public and private sector, we are confident that we will meet our goal of entering the top-third of global rankings ahead of schedule.

GUILLERMO M. LUZ

Co-Chairman, Private Sector