- Home

- |

- About Us

- |

- Working Groups

- |

- News

- |

- Rankings

- WEF-Global Competitiveness Report

- Ease of Doing Business Report

- IMD-World Competitiveness Yearbook

- TI-Corruption Perceptions Index

- HF-Economic Freedom Index

- WEF-Global Information Technology Report

- WEF-Travel and Tourism Report

- WIPO-Global Innovation Index

- WB-Logistics Performance Index

- FFP-Fragile States Index

- WEF-Global Enabling Trade Report

- WEF-Global Gender Gap Report

- Gallery

- |

- Downloads

- |

- Contact Us

PH in a ‘sweet spot’ (Malaya)

One of the greatest comeback stories in the past year has been the Philippines. The island nation has transformed from the “sick man of Asia” to a symbol of what gradual and steady reform can achieve.

The economy surpassed expectations by expanding 6.6 percent from 3.9 percent, exceeding its long-term output potential of 5 percent, a remarkable feat, especially given the backdrop of the global slump in 2012.

Remittances shielded the Philippines from sluggish external demand.

Timely fiscal and monetary policy also bolstered government and private consumption.

For this year, we revise our GDP forecast upward by 1ppt to reflect stronger growth in Japan, improved economic indicators from the US as well as unusually accommodative monetary policy both abroad and at home.

Consistently positive political and macro newsflow supports the case for the Philippines.

The Aquino administration has gained public trust according to opinion polls for his fiscal consolidation and anti-corruption efforts — refreshing for a nation with a history of colourful leaders.

The central bank has also kept headline inflation largely on target since the end of 2009, giving it space to support growth when necessary.

As such, both sensible fiscal and monetary policy will likely help the Philippines attain an investment grade rating in 2H2013.

Acquiring cheaper and more stable sources of funding will lay a foundation for the government to focus on broader reform agendas.

And a lot of work is still required. While the country is endowed with natural resources, a skilled labor force, favourable demographics, and a dynamic domestic market to counter the global slump, a still lacklustre infrastructure and business environment hinder investment and productivity.

Stagnant FDI inflows reflect challenges such as high costs of electricity, poor infrastructure, and restrictive ownership laws.

As such, we remain watchful of further reforms to transform the economy.

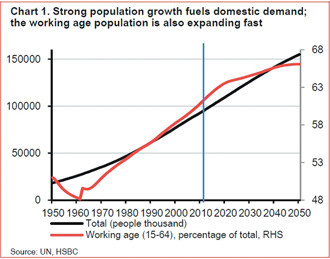

By the end of this year, the UN projects the Philippines population to reach 100 million. Of this, 70 percent is younger than 35 years old, making it one of the youngest nations in Asia.

The population is expected to expand rapidly into 2050, allowing the working age population to reach almost 70 percent of the total population by that year (Chart 1).

This has profound implications in that, should the government implement policy to educate and provide jobs for the burgeoning population, the Philippines could capitalize on its demographic advantages to raise economic output.

Thus, the optimism surrounding the country, while supported by confidence in the Aquino government and institutions such as the BSP, stems from the island nation’s inherent advantages.

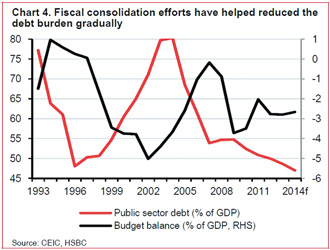

For example, despite rapid growth last year, inflation remained at the bottom of the BSP’s 3-5 percent target for most of 2012.

Chart 3 shows that since 2009, headline inflation has been relatively stable and on target.

This is thanks to policies to raise agricultural productivity, sterilization of capital inflows, and prudent monetary policy management.

With inflation benign, the BSP had space to reduce main policy rates by 100bp in 2012 to shore up domestic demand in anticipation of weak export performance. It also cut the special deposit account rates by 50-65bp in January 2013 to save money on sterilization costs and boost consumption.

Even with the sin tax implemented, headline inflation only rose to 3.1 percent y-o-y in January, which suggests that the central bank might cut SDA rates further at the next meeting.

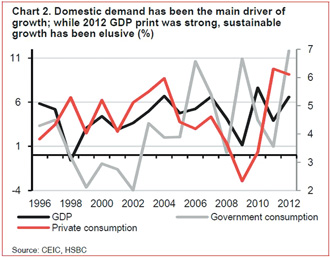

President Aquino’s fiscal consolidation efforts are also paying off. By pledging to refrain from tax hikes, the current administration employs efficiency measures to raise revenue collection as well as reduce waste in public spending.

The rolling out of this program slowed down growth in 2011 as construction investment and government spending declined.

But this helped lower the budget deficit to 2.0 percent from 3.5 percent of GDP in 2011.

In 2012, even with a rise in public spending, the budget deficit is expected to be below 3.0 percent of GDP thanks to higher revenue collection. For this year, we expect the deficit to remain below 3.0 percent of GDP (the government is targeting 2.0 percent).

Chart 4 shows that the public sector debt as a share of GDP is expected to decline steadily, improving the Philippines’ debt repayment sustainability.

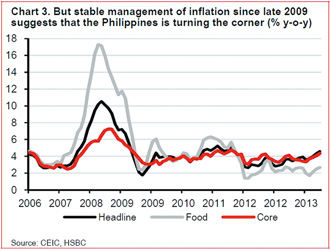

Chart 2 shows that both private and public spending supported growth in 2012 thanks to supportive monetary and fiscal policy.

This trend is expected to continue in 2013. Main policy rates are at a historical low of 3.5 percent and are expected to remain there for most of the year, as on-target inflation allows the BSP to do so.

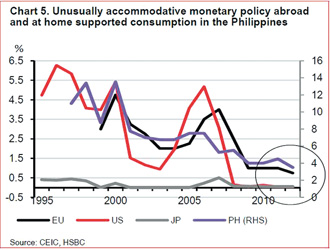

The sizeable cut of SDA rates to 3.0 percent will also have some stimulative effects on the economy. Coupled with this, monetary policy in the developed world is more than supportive (Chart 5).

Interest rates are close to zero in the US, the Eurozone and Japan. Both Japan and the US are carrying out aggressive quantitative easing, which means that some of this cheap capital will find its way to the Philippines, further boosting growth.

We believe the BSP will carry out macro-prudential measures to curb speculative flows but it is unlikely to implement any drastic capital controls as its objective is to allow market-driven factors determine the exchange rate.

Overseas Filipino workers (OFW) are also doing what they can to support family at home. OFW inflows rose above the BSP’s estimate of 5 percent to 6.3 percent in 2012, slightly down from 7.2 percent in 2011.

While remittances have been waning in importance as a share of GDP to 8.5 percent in 2012 from 9.0 percent in 2011, they continue to be vital to private spending in the Philippines.

More job contracts in the Middle East and Asia as well as strong demand for Filipino workers will keep remittances flowing in steadily in 2013 and we expect it to expand by 6.3 percent in 2013.

The business process outsourcing (BPO) sector (about 5 percent of GDP) is also booming. The BPO boom will support growth through the direct effect of enhancing income growth and indirect effect of enhancing other sectors such as real estate and retail.

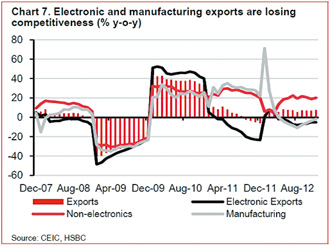

Exports, on the other hand, have been lacklustre. While some of this can be attributed to the appreciating peso other factors are at play.

Despite having a favorable base effect from a sharp contraction of 23.4 percent in 2011, electronic exports proceeded to decline in 2012 by 5.2 percent (Chart 7).

Both manufacturing and electronics are losing their shine. This is largely due to the Philippine’s uncompetitive infrastructure and relatively high labour costs. For example, the country has one of the highest electricity costs in Asia.

The business environment is ranked the worst in emerging Asia by the World Bank.

Coupled with this, an inefficient allocation of the labor market, caused by rigid minimum wage laws, result in labor un-competitiveness. As such, despite having surplus labor (around 20 percent of the labour force is underemployed and about 7 percent unemployed), the Philippines is not considered an attractive destination for manufacturing.

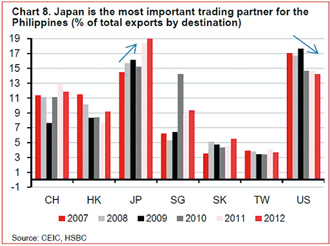

Looking ahead, we expect exports to be supported by better-than-expected demand from Japan driven by ‘Abenomics’ (see Chart 8, Japan is the biggest export destination) and positive growth indicators from the US.

However, as a whole, we do not expect a significant lift to growth from this sector but rather from internal demand.

Despite robust growth and steady reform efforts, foreign investors are still not convinced. This is evidenced by the underperformance of FDI inflows in 2012 from January to November, which remained close to the same level as 2011 at $1.2 billion.

Portfolio inflows have been strong, reflecting the bullish short-term economic outlook. However, FDI inflows are more indicative of investors’ perceptions of the government’s progress in resolving long-standing challenges.

While attaining an investment rating upgrade will likely have a positive effect on FDI inflows as funding becomes cheaper for corporations, foreign investors will be watchful of reform momentum such as improving electricity production, transportation, and most importantly easing restrictions on foreign ownership.

There are signs of progress. The government stated on 19 February 2013 that it will consider revising the foreign ownership law.

However, we think it will take time before these reforms are implemented and the earliest this could take place would be 2016, when President Aquino can afford to use his political capital to change the constitution.

The private-public partnership initiative has underperformed. This means that the country’s investment needs rest on public spending, which requires increased revenue collection.

To do so, either an increase in the tax rate or increasing the tax base (such as the mining sector reform) would be vital to generate funding. At the moment, both seem politically unviable. As such, FDI inflows will continue to underperform in the coming years.

But on the whole, the Philippines has gradually broken away from its tumultuous past. The nation is now looks on its way up with plenty of opportunities to look forward to.

A midterm legislative election is taking place on 17 May 2013, in which half of the seats in the Senate and all of the House of Representatives will be contested.

Opinion polls indicate the results will strengthen President Aquino’s Liberal Party position as his administration. What’s more noteworthy to watch is the replacement of President Aquino in 2016, which would signal whether the reform momentum in the Philippines will be sustained.

While a foundation is laid, reforms to long-standing challenges are still required. With the international community cheering it on, this is an opportunity that leaders of the Philippines should not squander.

By: TRINH NGUYEN Economist, HSBC Ltd.

original source: www.malaya.com.ph