Paying Taxes

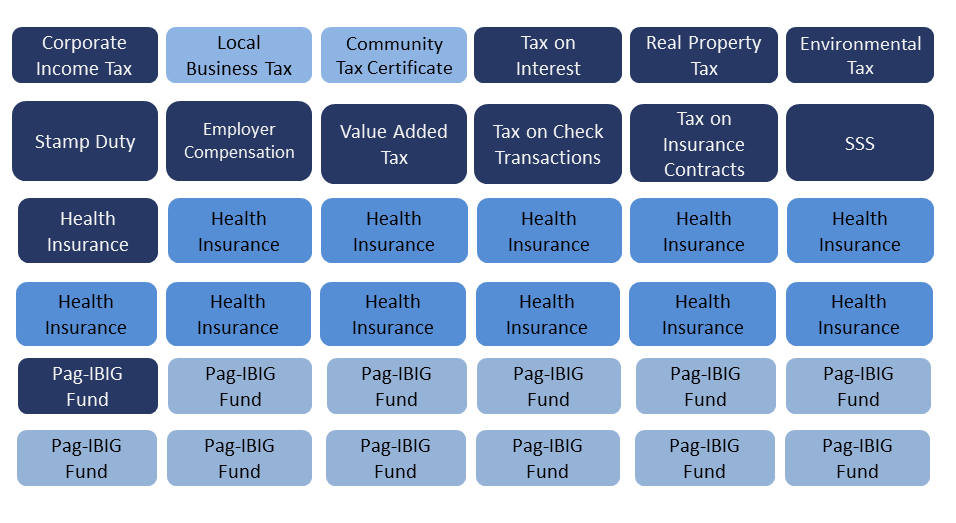

Records the taxes and mandatory contributions that a medium-sized company must pay in a given year, as well

as measures the administrative burden of paying taxes and contributions.

The ranking is derived from the number of tax payments per year, the number of hours per year to prepare

and file returns and pay taxes, and the total tax rate as % of profit.

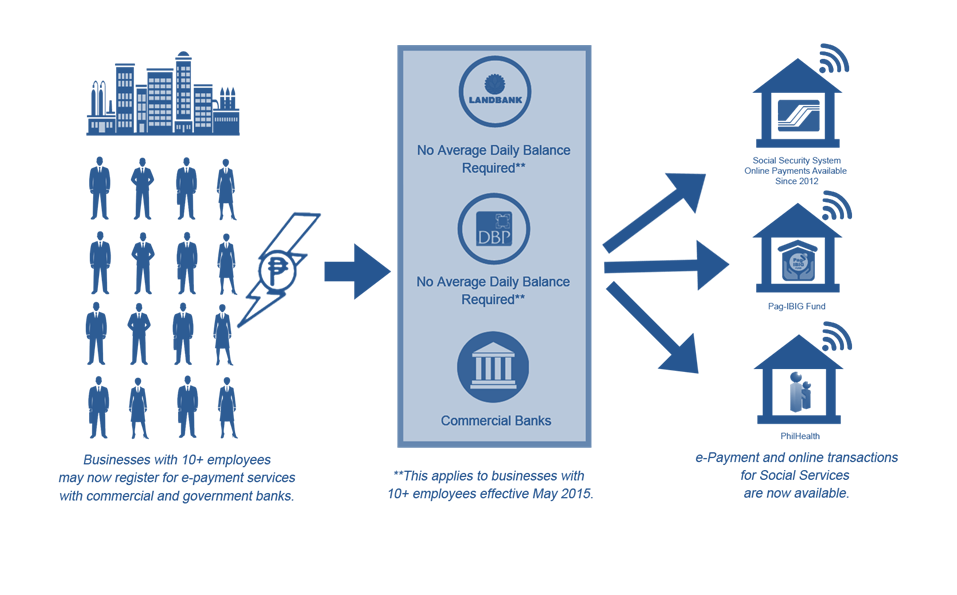

Reforms to reduce steps and days for Paying Taxes were also institutionalized and implemented this year. E-government initiatives including online payments to government financial institutions, such as Land Bank of the Philippines and Development Bank of the Philippines, offer accessible and convenient online transactions for payroll-related payments to the Philippine Health Insurance System (or Philhealth) and the Home Development Mutual Fund (or the Pag-IBIG Fund). The E-payment system allows business employers to open corporate accounts with "No Average Daily Balance", enabling employers to pay annually, thus reducing the number of payments from 36 to 13 annually.

REDUCED NO. OF PAYMENTS from 36 to 13

|

REDUCED NO. OF PAYMENTS from 36 to 13

|

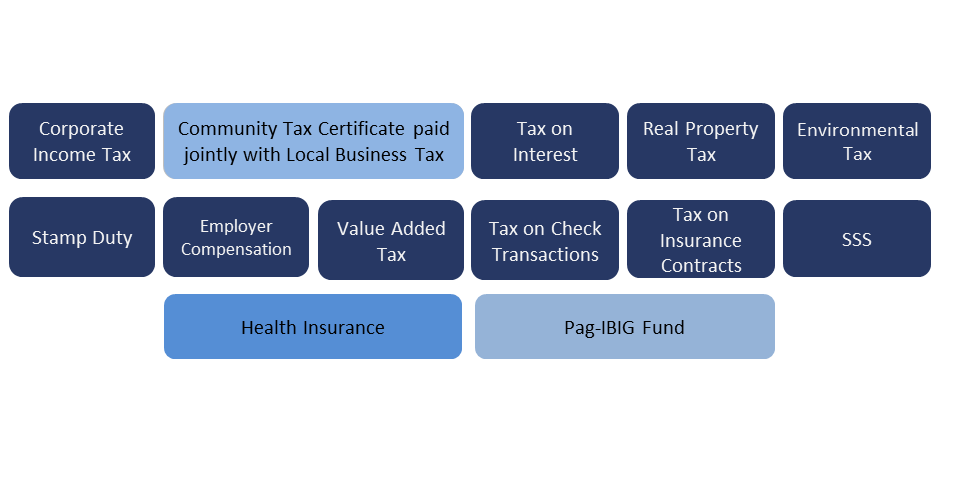

REFORMS

(Social Service Contributions/Payments)

REFORMS:

Reference Links:

Agencies

Quezon City Local Government Unit

Bureau of Internal Revenue

Pag-IBIG Home Development Mutual Fund

Philippine Health Insurance Corporation

Social Security System