Measures the efficiency of the local judicial system in resolving a commercial dispute.

The standard case used is the collection of a receivable by a seller who files a case

against a buyer who refused to pay for delivered goods on the grounds that the delivered

goods were not of adequate quality.

The indicator measures the time, cost, and procedures assumed by the plaintiff (seller) in pursuing the case.

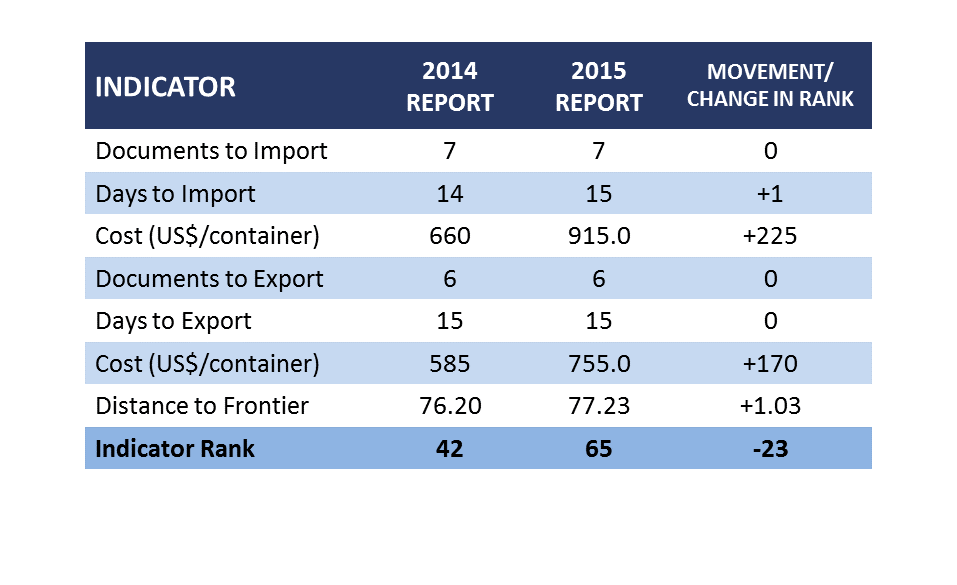

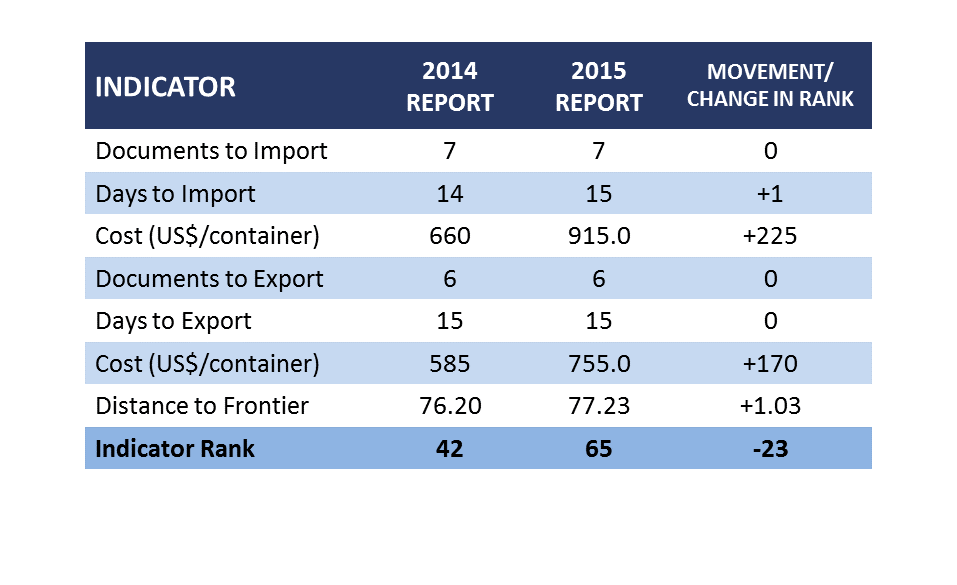

To continuously improve trade through facilitation of import and export processes:

REFORM DETAILS:

-

Customs Modernization and Tariff Act (CMTA):

This is an on-going reform which aims to modernize the Philippine Bureau of

Customs, and to update legislation at par with the best global practice of customs administration.

-

Authorized Economic Operator (CMO 11-2012; CMO 14-2013)

This is an internationally accepted customs procedure designed to create an accreditation procedure that offers certain benefits and incentives to certain economic operators considered as BOC’s trusted allies. This aims to reduce processing periods, last priority in post entry audits, recognition as a low risk company, reduced inspection or expedite clearance if covered by mutual recognition programs under bilateral/multilateral arrangements, and other trade facilitation benefits which the BOC may give under existing laws and regulations. An Executive Order was drafted to maintain the AEO Program in the BOC through the creation of an office which shall handle the AEO Program, as well as other trade facilitation initiatives.

-

Mandatory Submission of Electronic Sea and Air Manifest in e2m System (CMO 19-2015, 10-2015 & 23-2011)

This covers the electronic submission of Inward Foreign Manifest, consolidated cargo manifest and airline e-manifest to expedite the release of legitimate cargo and reduced time processing upon arrival in the Philippines.

-

Revised Procedures and Documentation in the Processing Formal Consumption Entries (CMO 29-2015)

The use of Import Entry and Internal Revenue Declaration (IEIRD) or BC Form 236 is discontinued and was replaced by printed Single Administrative Document (SAD), in two (2) copies, through e2m Customs System. Through this, BOC adapted the universal use of paperless transactions and eliminated unnecessary use of papers and expensive forms to minimize costs in the customs clearance of imported articles.

-

Implementation of the 2nd Pilot Project for the ASEAN Self-Certification

The system eliminates the need to present the Certificate of Origin (CO) Form D to claim preference under the ATIGA as it allows “Certified Exporters” to self-declare that their products have satisfied the ASEAN origin criteria by simply affixing a declaration on the commercial invoice. This aims to reduce the compliance (exporters) and administrative (issuing Authorities) costs associated with Certificate of Origin (CO) application and address implementation lapses e.g. delays in the release of shipments due to questions on minor technical and data errors, etc. Currently, the Philippines has three (3) Certified Exporters.

-

Terminal Appointment Booking System (TABS)

This was created to alleviate traffic congestion in response to the truck ban as imposed by the Philippine Government. This system fast tracks booking of containers, as status updates can all be done through mobile devices anytime. This aims for an efficient flow of containerized cargoes from terminals, resulting to a productive Philippine supply-chain.

-

Foreign Co-loading Act (RA 10668)

This act allowed foreign vessels to transport foreign cargoes to domestic transshipment port, thereby reducing cost of domestic transport and promoted the global competitiveness of importers and exporters. Its IRR was drafted by the BOC, together with various government agencies and representatives from the private sector.

Reference Links:

Customs Modernization and Tariff Act

Republic Act No.10668 Foreign Co-loading Act

MMDA Resolution No.2 s. 2016

CMO No.18 2015 Guildelines In The Implementation of The Second Pilot Project For The ASEAN Self Certification

CMO 11 2012 Establishing R and R for the Authorized Economic Operator (AEO) Program

CMO 14 2013 Establishing Rules and Regulations for the Authorized Economic OPerator (AEO) Program

CMO 29 2015 Revised Procedures and Documentation in the Processing Formal Consumption Entries

CMO 23 2011 Submission of Airline e-Manifest throught a Value Added Service Provider VASP

CMO No.10 2015 Mandatory Submission of Manifests for Air Cargo

CMO No.19 2015 Revised Procedures For The Mandatory Submission of Electronic Sea Manifest In E2M

Agencies

|

Bureau of Customs |

|

Export Development Council |